what tos study to use to compare stocks?

Charts That Rule the Earth: A thinkorswim® Special Focus

There's more to charts than looking at price and volume. Acquire how to apply these five charting tools as a starting point in understanding the many features available in thinkorswim charts.

August xi, 2020

Photo by Getty Images

Key Takeaways

-

Become familiar with the different charting features available on thinkorswim

- Sympathize how to compare charts, create drawing alerts, and backtest strategies direct from price charts

- Use the expansion area of a cost chart to place future corporate actions and probable price ranges

There are plenty of charting programs out there. But seriously, why look further? The charts on the thinkorswim trading platform can practise pretty much everything y'all could possibly need— even if you're not a nautical chart reader. Want to compare two stocks on one chart? No problem. What virtually setting an alert for when price breaks out of a trendline? Want to do a petty backtesting earlier jumping into a trade? Yous're covered. What about technical indicators, you ask? The platform has hundreds of preloaded studies and strategies. Yous tin even develop your own studies correct in thinkorswim. If you're new to charting, you can brush upward on technical analysis and how to read stock charts. Allow's map out some of the features that chartists and (non-chartists) can use in day-to-day trading from the Charts tab on thinkorswim. An overlay chart plots ii or more dissimilar stocks or indices on the same toll nautical chart. It's a way to see relative performance—whether one is over- or underperforming the other. It can be a way to measure relative strength, and it'due south likewise handy if you're looking at correlations between stocks, sectors, or asset classes such as the fiscal sector versus the Southward&P 500 Index (run into figure 1).Overlay Charts

Figure 1: Comparison NOTES.Use the overlay function in thinkorswim to compare 2 symbols: in this case the S&P 500 Alphabetize (SPX, candlesticks) and the financial sector (IXM, regal line). Data source: S&P Dow Jones Indices. Chart source: the thinkorswim platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

Ready to requite it a try? Here'south how to create an overlay: The left vertical centrality will exist scaled for the overlay symbol so the high and low range fits on the same chart. You can also add together more indices or custom symbols. To take overlays one step further, openChart settings (gear icon), and under theCost Axis tab and bank checkEvidence cost equally percentage. That switches the correct vertical centrality to evidence pct changes, which may help y'all compare the operation of the symbols you're charting. Did you know yous can fix alerts based on nautical chart drawings such equally trendlines, retracement levels, price channels, and so on? Whenever a security'south toll breaks through a tendency yous've defined, you'll be notified. Setting upward such an alert is straightforward. Simply select a drawing and right click to selectCreate alert with drawing.... This opens up a dialog where you can ascertain how you'd like the warning to trigger (encounter figure 2). Because all drawings are (in issue) simple lines, alerts can trigger when prices cross them. Across that, all the standard alarm preferences can exist set up from this menu, such every bit the notification method or when the alert should expire. One time y'all enter the parameters, select Create to set the alert. A flag appears on the chart drawing to betoken that an alert has been set. You can edit or abolish the alert by right-clicking the flag. Earlier creating the warning, you can also check the Show Alert Book after I printing 'Create' box. This will add the cartoon alarm to the Warning Book section of the MarketWatch tab, forth with any other alerts you've set. You'll see the proper noun of the drawing and symbol for each alert, besides as the time frame of the applicable chart. This last bit is important to continue in mind to avoid confusion. The slopes of lines change when they're practical to unlike chart aggregations, so remember that an alarm will trigger only when a crossover occurs on the same aggregation every bit the original chart. For example, it'southward possible to see a crossover on a 15-infinitesimal chart that doesn't appear on a 5-minute chart. If the alert was created on the 5-minute chart, then it wouldn't trigger. To remind you of this, the flag will show upwardly but on charts of the same aggregation, and the entry in the social club book will specify the aggregation besides.

Drawing Alerts

FIGURE 2: TREND ALERT! Add alerts based on chart drawings to be notified when a stock smacks through the bottom of a trendline or breaks out above it. Chart source: the thinkorswim platform from TD Ameritrade. For illustrative purposes just. Past performance does not guarantee future results.

You lot can backtest trading strategies based on technical indicators and see the hypothetical profit & loss (p&l) performance right on your charts. The charts offer "Strategies," which are faux long and brusque entry and closing points determined by a technical indicator. Y'all can fifty-fifty code your own strategy. That'due south beyond the scope of this article, but here's how to get started (run into effigy 3).Backtesting*

FIGURE 3: Existent Test, Imitation Money.Backtest a strategy to see how it might accept performed historically. And then view the entry and exit points on the chart, too equally a p&l, before committing real dollars. Chart source: the thinkorswim platform from TD Ameritrade.For illustrative purposes only. Past performance does non guarantee future results.

To attempt out backtesting: Y'all should now run into "BollingerBandsLE" and "BollingerBandsSE" labels on your chart, indicating the simulated buying and selling of 100 shares of stock based on the Bollinger Bands test. To encounter the p&l of those simulated trades, hover directly over one of the labels and right-click to open a new menu. SelectEvidence Report to open theStrategy Report window. Here you lot'll find the buy and sell signals and p&l data for the strategy. And past the way, if you want to buy or sell the stock shares for real, right-click in the chart's main body and selectBuy orSell from the menu. Plus, at the far correct of the nautical chart, you'll come across tabs forMerchandise,Time and Sales,Level 2, and and then on. These allow you add windows with those features side by side to the chart window. It basically lets you set up Chartsas your get-to page for stock and futures trading. A terminal note on backtesting. Never forget the old adage (and standard fiscal disclaimer): By functioning of a security or strategy does non guarantee time to come results or investing success. It's particularly important when backtesting for strategy selection. thinkorswim charts let yous plot future dates to the right of the current appointment. Why? To assistance you lot locate upcoming earnings and dividend dates, for one thing. Plus, y'all can extend drawings like trendlines off into the future to identify possible price targets. How to exercise it? Accept a look at figure 4.

Futurity Corporate Actions

FIGURE 4: PEEKING AT THE FUTURE.Past adjusting a chart to display future bars on the right (the expansion area), you can view upcoming earnings and dividend dates. Chart source: the thinkorswim platform from TD Ameritrade.For illustrative purposes just. By functioning does not guarantee future results.

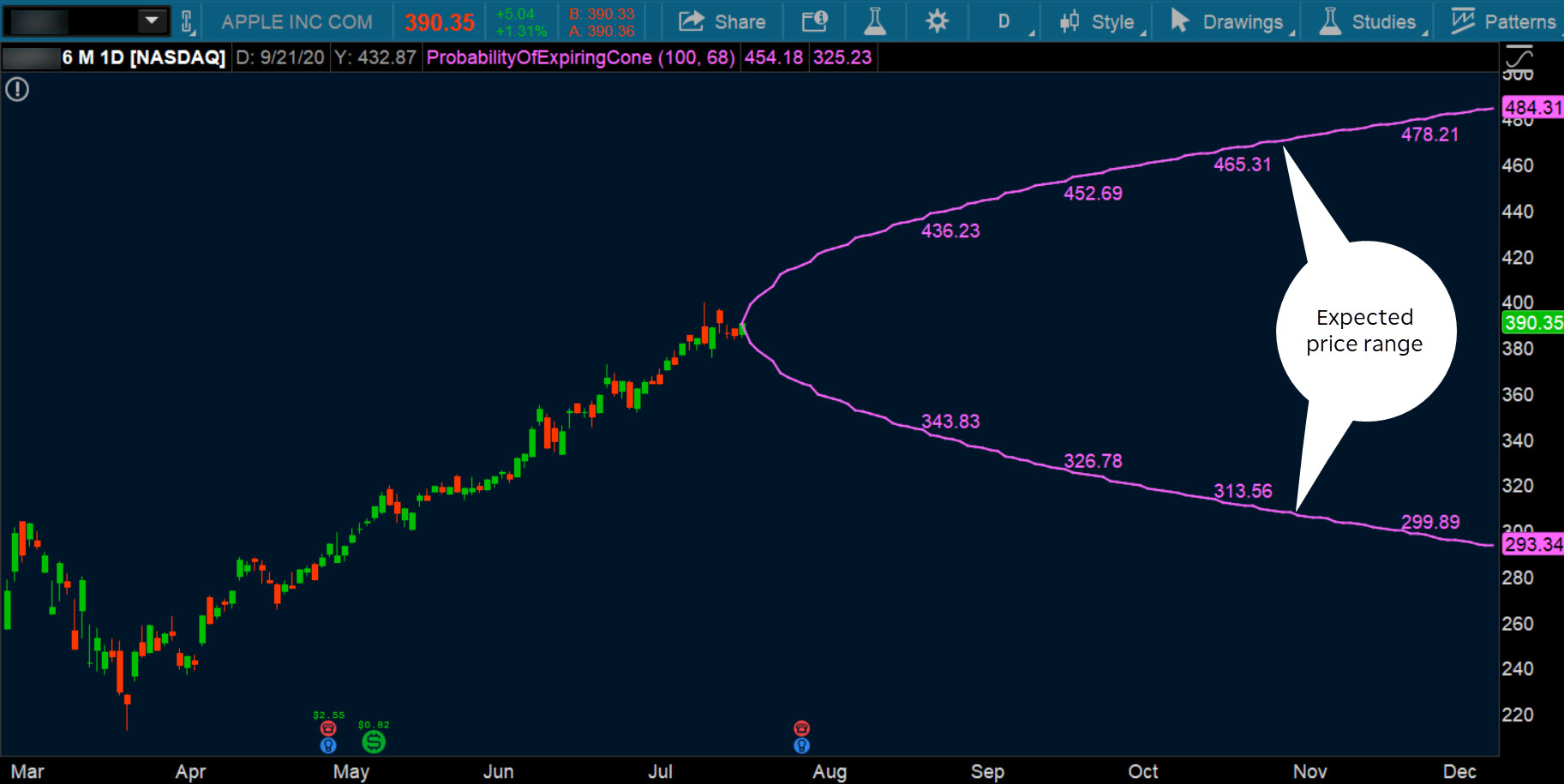

To nautical chart a future period in the expansion area: This will add some empty space to the right of the current date on the chart (run across figure 4). At present yous can extend a trendline or other drawing into that space. Hover directly over the trendline and correct-click. SelectExtend to the right from the bill of fare and y'all'll encounter the line extend to those future dates. A written report that'due south built specifically for those hereafter dates is theProbability of Expiring Cone (effigy 5), which gives you a probable cost range at unlike contract expirations (weeks or months). The cone draws the upper and lower bounds of a symbol's price range to theoretically embrace a predefined level of probability.

The Absurd Probability Cone

Effigy 5: WHAT'S THE Likely PRICE RANGE? The probability cone (majestic bend) helps to estimate the upper and lower bounds of a stock or index's price range within a predefined level of probability. Nautical chart source: the thinkorswim platform from TD Ameritrade.For illustrative purposes only. By operation does not guarantee future results.

One fashion to add together the cone study is to select Studies >Edit studies icon and discoverProbabilityOfExpiringCone on the left of the window. Double-click to add it to the listing of nautical chart studies. Yous'll likewise find ii fields to edit for the study. The "menstruation" is the number of future dates for which the probability cone is calculated, and the "prob range" is the probability the projected range covers. The default "prob range" is 68%, which corresponds roughly to one standard departure. Gear up it to 95% to see a cone that covers two standard deviations, or 99% to cover three standard deviations. (Learn more about probabilities and volatility.) These features actually just scratch the surface of thinkorswim charting functionality. Only hopefully you at present have an idea of the telescopic and how to access some of the potential. Each of the many menus offers more choices that will lead you to additional functions. Go ahead and continue to explore thinkorswim charts to see only how hard you can make them piece of work for you.

Key Takeaways

-

Become familiar with the different charting features available on thinkorswim

- Sympathize how to compare charts, create drawing alerts, and backtest strategies straight from price charts

- Use the expansion expanse of a price chart to identify future corporate actions and probable toll ranges

Starting time your email subscription

Recommended for you

Related Videos

Source: https://tickertape.tdameritrade.com/trading/thinkorswim-tools-tips-charts-16608

Post a Comment for "what tos study to use to compare stocks?"